Palladium Network Introduction

Palladium, a hybrid system that merges real-estate–backed NFTs with an automated arbitrage engine to offer stable returns and reduced volatility in digital markets. By tokenizing select properties and channeling a portion of arbitrage profits into buybacks of Palladium’s native token (PLLD), the platform provides both tangible asset security and liquidity advantages. This litepaper outlines the tokenization models, buyback mechanism, vesting schedules, and the architectural foundations designed to democratize premium real estate ownership while incentivizing rational market behavior. Palladium converges tangible real estate value with high-frequency arbitrage to produce a more stable and transparent blockchain environment. Through fractional NFTs, investors gain direct access to income-generating properties, while arbitrage-driven buybacks anchor PLLD’s market performance. This unified approach aims to diminish speculation, expand market liquidity, and democratize prime real estate investing—offering participants a balanced, sustainable path forward in the digital asset realm.

Palladium Network (PLLD) – Bridging Real-World Assets with Blockchain Utility Palladium Network (PLLD) is a pioneering project that merges the transparency and efficiency of blockchain technology with the tangible value of real-world assets. Operating as an ERC-20 token on the Ethereum blockchain, PLLD is designed to empower users through real asset backing, decentralized finance (DeFi) integrations, and tokenized ownership models. At its core, PLLD aims to create a robust digital ecosystem where token holders are not just passive investors but active participants in a growing asset-based economy.

Palladium MISSION And VISION

Palladium democratizes access to real estate and crypto investments by combining stability, transparency, and innovation, fostering a more equitable financial future. To build a globally trusted platform where advanced technology and tangible assets empower both individuals and institutions equally. The project’s roadmap includes real estate acquisitions, tokenized property NFTs, and community-governed treasury strategies. Its approach emphasizes long-term sustainability, real-world utility, and trustless transparency. One of the core features of the Palladium Network is its use of acquired physical assets—such as real estate—to back and support the value of its token. The project has already secured its first property: a scenic mountain cottage near a ski resort, which is in the process of being tokenized and offered to the community in fractional NFT format. This real-world linkage provides a degree of intrinsic value to PLLD, setting it apart from purely speculative crypto assets.

PLLD also incentivizes its community through loyalty rewards, staking systems, and regular airdrops for long-term holders. These mechanics are designed to reward true believers in the ecosystem, discourage short-term speculation, and build a resilient token economy. As the treasury grows and more assets are added to the portfolio, the value proposition of holding PLLD becomes increasingly attractive. The team behind Palladium Network brings a combination of experience in crypto markets, real estate, and technology, working with transparency and dedication to sustainable growth. Palladium Network offers an innovative and grounded approach to blockchain finance. Whether you're an investor seeking asset-backed exposure, a community member interested in tokenized ownership, or a DeFi enthusiast looking for real utility—PLLD provides a compelling and future-forward opportunity in the crypto space.

How Palladium Works

Step 1

Arbitrage Engine: Profits from crypto market inefficienciesStep 2

Real Estate Tokenization: Fractional property ownership for stable returnsStep 3

Ecosystem Integration: Seamless trading via the PLLD Token

Real Estate Tokenization

Palladium’s Real Estate NFTs convert carefully selected real-world assets into fractional ownership tokens:

Selection & Due Diligence: Properties undergo legal, environmental, and financial assessments. Only high-quality assets enter the portfolio to ensure reliability of rental and resale income.

Fractional Ownership: NFTs represent proportional stakes in each property. Holders receive direct exposure to rental yields and potential value appreciation.

Legal Structuring: Assets reside in Special Purpose Vehicles (SPVs) to maintain clear titles, separate liabilities, and ensure compliance with local property laws.

Why Stake PLLD?

Staking offers multiple benefits to the community and the ecosystem:

- Passive Rewards: Let your tokens grow over time with guaranteed returns.

- Strengthen the Network: Your stake helps secure and stabilize the ecosystem.

- Back the Vision: Your participation is a vote of confidence in a network that aims to bridge real-world assets with digital potential.

Palladium (PLLD) Gets Listed on Poloniex

The Palladium Network has reached another important milestone: PLLD is now officially listed on Poloniex, one of the most recognized and user-friendly cryptocurrency exchanges in the world. This listing marks a huge step forward for the project’s visibility and accessibility. Poloniex, known for its global user base and long history in the crypto space, provides a trusted environment for traders and investors to access promising tokens like PLLD.

With PLLD now tradable on Poloniex, users can enjoy:

- Increased Liquidity – Easier entry and exit points for both newcomers and seasoned investors.

- Global Reach – Access to a wide international audience that helps strengthen Palladium’s community.

- Credibility & Growth – Being listed on a respected exchange highlights the project’s legitimacy and its roadmap for the future.

The listing also reinforces Palladium’s mission: to connect real-world assets with blockchain innovation through NFTs, staking, and arbitrage-powered rewards. With broader exchange support, more people can now participate in this ecosystem and benefit from its unique approach. This is more than just another exchange listing—it’s a strong signal that Palladium is building for the long term and positioning itself to become a key player in bridging traditional and digital economies.

Swap Implementation: PLLD Swap for Seamless Trading

The PLLD Swap plans to be one of the key services of Palladium’s ecosystem, set to launch within 6 to 12 months after the platform’s initial release. The swap is designed to generate liquidity and simplify trading, enabling users to securely exchange PLLD tokens and other cryptocurrencies. By offering an intuitive interface and smooth transaction processes, the PLLD Swap aims to deliver an experience that is aligned with the best practices of cryptocurrency trading platforms.

How PLLD Swap Works

Wallet Connection

Users connect their wallets via Web3 integration, enabling access to their balances for initiating swaps.Token and Chain Selection

The user selects the cryptocurrency they wish to swap and the blockchain network on which the transaction will occur.Real-Time Pricing and Confirmation

The platform displays live market prices, estimated slippage, and transaction details for user confirmation before proceeding with the swap.Seamless Swap Execution

Transactions are executed securely within the ecosystem, and the exchanged cryptocurrency is credited directly to the user's upon completion of the swap.

Benefits of PLLD Swap

Enhanced Liquidity:

The swap ensures consistent and deep liquidity for PLLD tokens and other supported cryptocurrencies, providing a reliable trading environment.Synergy with Arbitrage Engine:

The PLLD Swap complements the platform's arbitrage engine by optimizing liquidity channels and enhancing price efficiency. This synergy ensures users benefit from stable token values and tighter spreads, indirectly contributing to the broader ecosystem's rationalization.

Future Plans for PLLD Swap

Expanded Token Support: The swap will continually expand its range of supported tokens and trading pairs to enhance utility.

Advanced Analytics: Future iterations may include market analytics and order customization features for more strategic trading.

Incentive Programs: Users may benefit from loyalty rewards, reduced fees for PLLD holders, and other promotional incentives to encourage engagement.

Integration with Ecosystem Features: The PLLD Swap will integrate with Palladium’s broader offerings, such as NFT investments, ensuring a cohesive user experience across all products.

Utility of the PLLD Token: Economic Incentives and Ecosystem Synergy

The PLLD token is designed to capture value generated by Palladium’s sophisticated arbitrage trading strategies, creating a straightforward but powerful profit-sharing mechanism. Unlike NFTs, which tie returns to specific real estate properties, PLLD tokens focus exclusively on arbitrage-derived value—ensuring distinct, transparent benefit streams for each participant type.

PLLD as a Keystone Asset: Bridging Arbitrage Success with Investor Rewards:

PLLD tokens connect investors to the potential profitability of arbitrage trading without requiring any hands-on market activity. While Palladium’s high-performance engine aims to secure consistent returns, no yields are guaranteed:

- Scalable Growth: Arbitrage strategies exploit crypto market inefficiencies to pursue reliable gains, but market volatility can affect outcomes.

- Predictable Returns: Regular buybacks—funded solely by arbitrage profits—help PLLD holders share in the platform’s success. However, actual results may vary based on broader market conditions and unforeseen risks.

Profit-Sharing Through Arbitrage-Driven Buybacks:

Palladium’s direct, transparent profit-sharing model leverages arbitrage proceeds to support PLLD tokens:

- Buybacks from Arbitrage Profits: A percentage of trading profits is periodically allocated to buying PLLD on the open market—boosting demand and potentially strengthening the token price.

- Redistribution of Value: Purchased tokens remain in the company’s treasury, reducing the circulating supply and indirectly supporting PLLD’s market position.

- Transparency: Regular performance reports summarize arbitrage activity, buyback schedules, and the total tokens repurchased, ensuring holders have a clear view of token dynamics.

Distinction Between Real Estate NFTs and PLLD Tokens:

Separating real estate yields from arbitrage revenues ensures clarity for different investor preferences:

- Real Estate Income for NFT Holders: Rental income and appreciation benefits accrue exclusively to holders of fractional real estate NFTs—those investing directly in specific properties.

- Arbitrage Profits for PLLD Holders: In contrast, PLLD buybacks flow solely from arbitrage trading success, providing a channel for investors who prefer a market-based (rather than property-based) reward structure.

PLLD as a Benchmark: Redefining Arbitrage-Backed Tokens"

By anchoring PLLD’s value to arbitrage profits, Palladium underscores simplicity and traceability:

- Clear Purpose: Linking token returns directly to trading results avoids overlapping income sources, simplifying the investment proposition.

- Trust and Reliability: Publicly verifiable buybacks based on transparent arbitrage outcomes build holder confidence—though no profit can be guaranteed.

- Industry Inspiration: PLLD demonstrates how decentralized finance and real asset tokenization can coexist, setting an example for other platforms seeking clear, profit-sharing mechanisms.

Driving Rational Behavior: Stability Over Speculation"

By focusing on real arbitrage earnings rather than hype-driven token emissions, Palladium promotes healthier market conduct:

- Measured Growth: Arbitrage-driven buybacks can support long-term token appreciation, but all participants should be mindful of inherent market risks.

- Data Transparency: Published arbitrage metrics and buyback data allow investors to base decisions on evidence rather than speculation.

- Market Maturity: Minimizing reckless price pumps and focusing on tangible value creation can encourage deeper liquidity and reduced volatility across the ecosystem.

Tokenomics

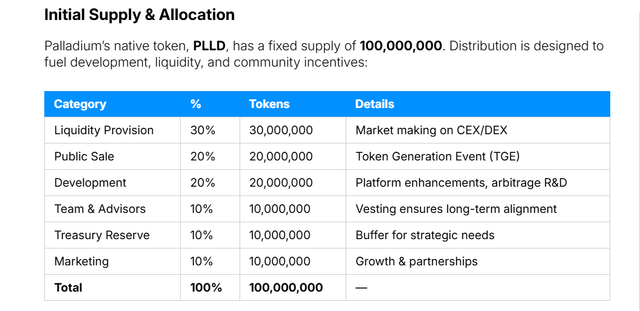

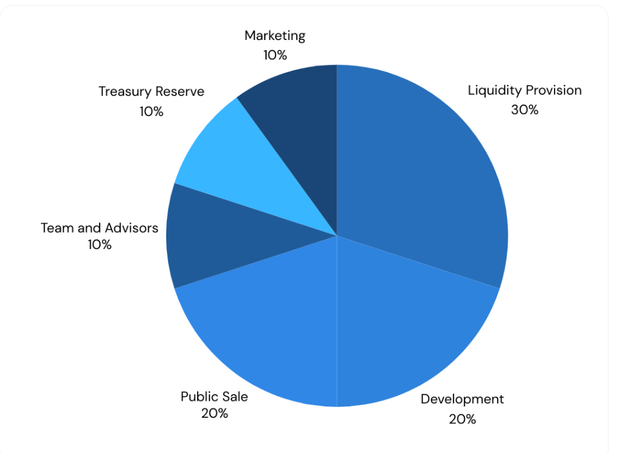

Palladium’s native token, PLLD, has a fixed supply of 100,000,000. Distribution is designed to fuel development, liquidity, and community incentives:

- Liquidity Provision- 30%- 30,000,000- Market making on CEX/DEX

- Public Sale- 20%- 20,000,000- Token Generation Event (TGE)

- Development- 20%- 20,000,000- Platform enhancements, arbitrage R&D

- Team & Advisors- 10%- 10,000,000- Vesting ensures long-term alignment

- Treasury Reserve- 10%- 10,000,000- Buffer for strategic needs

- Marketing- 10%- 10,000,000- Growth & partnerships

Vesting Schedules

Development (20%)

- Lockup: 6 months post-TGE

- Vesting: Gradual release from Month 7 onward, aligning with platform milestones (e.g., Swap launch, real estate tokenization).

Team & Advisors (10%)

- Lockup: 6 months post-TGE

- Vesting: Linear over 25 months to maintain focus on long-term success.

Treasury Reserve (10%)

- Lockup: 12 months post-TGE

- Vesting: Linear release, offering flexibility for unforeseen requirements and strategic expansion.

Marketing (10%)

- Lockup: None

- Vesting: 25% released at TGE, remaining 75% over the next 12 months to support sustained growth and user acquisition.

These schedules prevent sudden token floods, safeguarding market stability and incentivizing ongoing project development.

Buyback Mechanism

Central to Palladium’s sustainability is a profit-sharing buyback system, where a portion of arbitrage returns fund PLLD repurchases:

- Arbitrage Earnings: Profits generated from market inefficiencies are channeled into the buyback pool.

- Periodic Token Buys: At randomized intervals, Palladium buys PLLD on the open market to thwart predictable front-running and speculation.

- Supply Reduction: Tokens are transferred to the treasury or retired, effectively shrinking circulating supply and potentially supporting the token’s market value.

Transparent Reporting" Quarterly disclosures detail total tokens repurchased, expenditure, and transaction references for on-chain or exchange verification.

Roadmap

Phase 1 (0–6 Months)

- Expand arbitrage coverage to multiple exchanges

- Conduct buybacks from initial trading profits

- Complete preliminary audits

Phase 2 (6–12 Months)

- Launch PLLD Swap

- Roll out first fractional real estate NFTs

- Integrate advanced arbitrage (options, futures)

Phase 3 (12+ Months)

- Diversify global property portfolio

- Implement AI-based arbitrage modules

- Maintain ongoing buybacks and periodic vesting updates

Stay connected with us:

- Website: https://plld.net/

- Twitter: https://x.com/DDTechGroup

- Telegram: https://t.me/Palladium_PLLD

- Whitepaper: https://plld.net/whitepaper

- View PLLD on CoinGecko: https://www.coingecko.com/en/coins/palladium-network

Author:

Bitcointalk username : Spartacus1971

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2587769

Smart Chain Wallet (BSC) Address: 0xb2c62391cce67c5efc1b17d442ebd24c90f6a47c