About EstateX:

EstateX is a vision that was born and is here to stay. The core team aspires to disrupt the real estate market and bring transformation to the future of investment and property ownership. The core team aims to break down barriers to make real estate investing easy, inexpensive and accessible to participants interested in being able to achieve the benefits of investing in real estate. With the extraordinary EstateX concept, private individuals will be able to start building a passive income generating property portfolio with an investment as low as $100. The Estatex Ecosystem will be backed by its native token called the ESX Token and the Blockchain based EstateX Ecosystem will certify fractional ownership of properties which can be easily bought, sold or traded; lower barriers to entry and also supply liquidity. Decentralized Finance knowledge, tools and solutions to benefit from real estate investment opportunities that previously only benefited high net worth Institutional and individual investors.

Problems in the Real Estate Industry:

First Problem: High Barriers to Entry:

This is the most challenging problem in the Real Estate industry because a lot of capital is required to enter as an investor. Risk is also involved as with any other business but here if a proper feasibility study is not made, land topography can create problems and rising inflation rates can make it difficult to profit. Phenomenal creditworthiness is also required to make any investment successful.

Second Problem: Spending Time and Money:

Building a plantation is very time consuming and involves a lot of capital. Many resources need to be hired and Labor needs to be hired. All of this can cost money in the long run. So this is putting off a lot of potential investors who could benefit from this field.

Third Problem: Low Liquidity;

Often, selling properties that have already been built takes time, thereby tying up funds temporarily. Traditional lending is time consuming and also inflexible which makes the whole process look sluggish.

Fourth Problem: Poor Financial Literacy:

Many investors lack financial education and allocate resources inappropriately when projects are being developed. Financial management is the key to the success of any real estate project. Second, many investors don't know how to invest in the real estate industry and lose money using a trial and error approach. All of these make for success in this genre.

Fifth Problem: Rising Global Inflation:

Property prices and even the materials used to build them are increasing at an alarming rate due to global inflation. Currently the United States, Great Britain and other world powers are experiencing inflation, causing the devaluation of FIAT currencies. This makes it difficult for potential investors to enter this capital-intensive field even without inflation.

EstateX solution:

The core team at EstateX are about to introduce some nifty approaches to address this issue. These solutions are solutions born from the consideration and prudence of the real estate industry. This solution is a direct solution to the problems mentioned above in a proportional order.

First Solution: Breaking Down Barriers:

As a solution to the high entry price that limits many investors from entering the genre. The Estatex core team has introduced fragmented property ownership rewards on the Blockchain network. With this, the costs of building plantations will be shared and every transaction will be published on the Blockchain network which is a public ledger that promotes transparency.

Second Solution: Instant Liquidity:

The core team has made it possible to trade around the clock on the secondary market. Raising direct finances from asset-backed tokens is also possible; making finding sources of funds an easy ordeal. At a later date, payments will be made from the real estate investment.

Third Solution: Hassle Free Property Management:

EstateX investors have a penchant for expediting transactions, Management and Maintenance. The need to involve the corporation to carry out the stated actions is unnecessary. EstateX investors drive investments.

Fourth Solution: Financial Empowerment:

EstateX's core team aims to empower their community with the financial education resources and knowledge, tools, and assistance needed to secure their financial freedom.

Fifth Solution: Inflation Hedging:

Property ownership helps investors secure a hedge against inflation. Because the prices of goods, services and commodities tend to increase, physical real estate assets also tend to increase in value over time. This provides the economy with a shock absorber against inflation.

How Does EstateX Work?

Our process is simple and straightforward. First, you create an account on our website and deposit funds into your account via bank transfer or credit card. Then, you select which properties you would like to invest in and how much you would like to invest (€100 minimum). Once your investment is processed, you will start earning regular dividends from your invested properties as they generate revenue over time. You can also use our platform to monitor the performance of your investments and track how well they are doing compared to other similar investments.

What Are The Benefits?

The benefits of using EstateX are numerous. By having access to fractionalized ownership of real world property investments, anyone can now reap the rewards associated with investing in real estate without having large amounts of capital upfront. Our platform also offers users greater transparency than traditional investment platforms, allowing them to easily track their investments and see exactly where their money is going. Plus, because our platform runs on blockchain technology, there’s no need for intermediaries or middlemen—ensuring faster transaction times and lower costs for everyone involved.

.jpg)

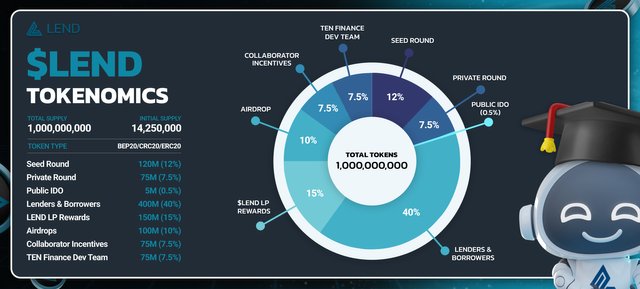

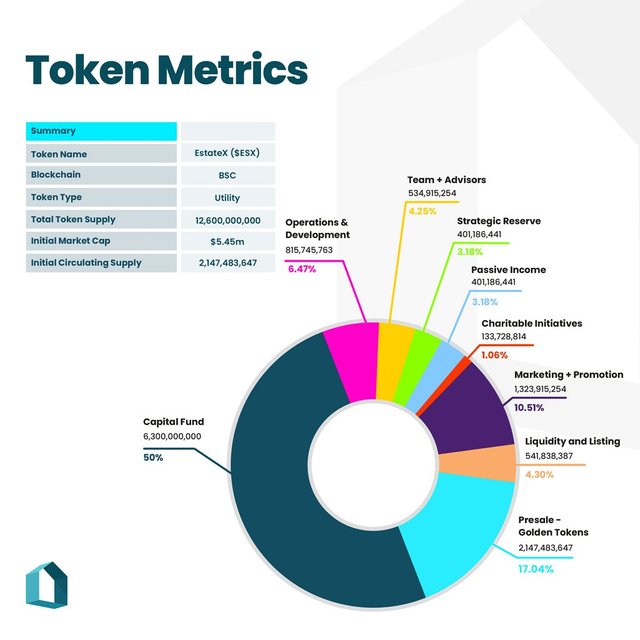

Tokenomics:

- Token name: EstateX ($ESX)

- Blockchain: BSC

- Token Type: Payments/Utilities

- Maximum Token Supply: 6,300,000,000

- Initial Market Cap: $467,588

- Initial Circulating Supply: 158,504,573

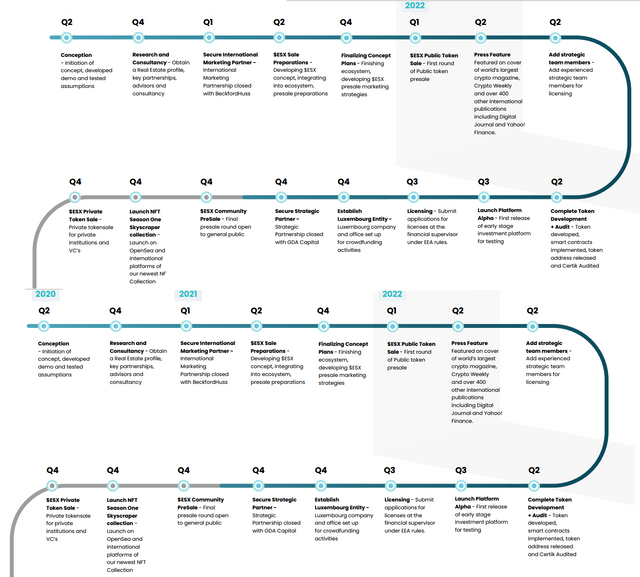

Roadmap:

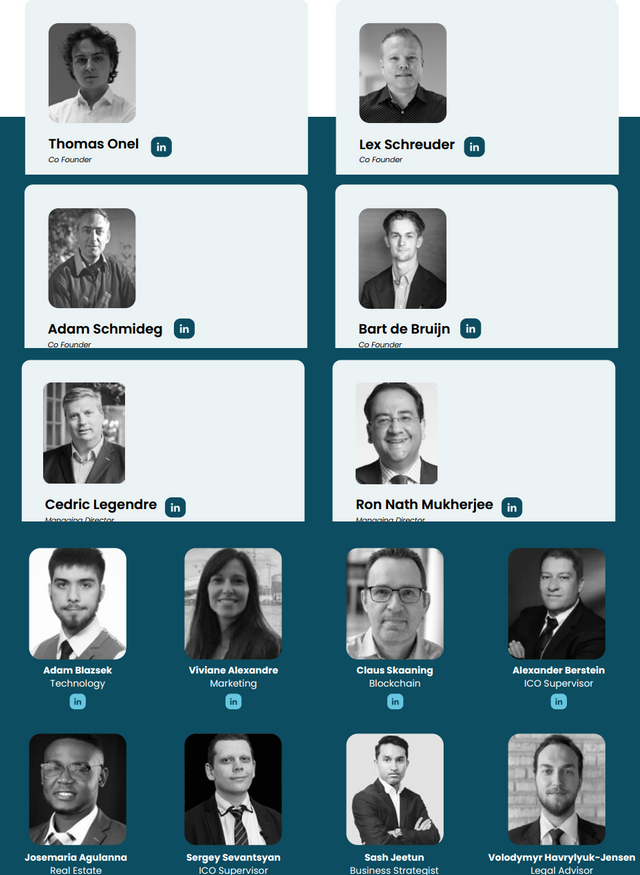

The core team:

Conclusion:

Investing in real estate has never been easier thanks to EstateX! With us, anyone can build their own property portfolio with just €100 or more and start earning a regular passive income from their investment over time. Our revolutionary platform leverages blockchain technology so users have greater transparency into where their money is going and faster transaction times at lower costs than traditional investment platforms offer. Join us today and help us break down barriers that have previously stood in the way of investing in real estate!

More information

Official website: https://estatex.eu/

Telegram group: https://t.me/estatexofficial

Youtube: https://www.youtube.com/channel/UC4_8wX5yrPYR3lnZVVjPjFQ

Twitter: https://twitter.com/estatexeu

Facebook: https://www.facebook.com/EstateXeu

Reddit: https://www.reddit.com/user/EstateXeu

Linkedin: https://www.linkedin.com/company/estatex-eu/

Instagram: https://www.instagram.com/estatexeu/

Author:

Bitcointalk username : Spartacus1971

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2587769

Smart Chain Wallet (BSC) Address: 0xb2c62391cce67c5efc1b17d442ebd24c90f6a47c

.jfif)